Last Updated on by SiteControl

Aetna, one of the nation’s largest insurers, purchased Coventry nine years ago for more than $7 billion. Coventry offered plans in Pennsylvania through Health America. A wide range of Senior Medicare plans were offered, along with Medicaid Worker’s Compensation, and behavioral coverage. Corporate facilities were located in Pittsburgh and Harrisburg.

Group coverage through small and large employers were also offered. Affordable monthly premiums are currently available with many flexible policy options. A large network helps provide physicians, specialists, medical facilities, and hospitals close to your home or work.

Aetna Advantra Insurance Medicare Plans In Pennsylvania

Advantra plans are issued through Coventry. Together, the two carriers offer managed care products, plans, and services to individuals, businesses, insurers, and government agencies. Although Advantra does not market Supplemental coverage, they do offer PPO and HMO Advantage plans. Shown below are the most current policy options:

Advantage Plans

Aetna Medicare Advantra Eagle (HMO) – $0 monthly premium with $4,000 maximum out-of-pocket expenses. Primary care physician and specialist visit copays are $0 and $35. The in-hospital stay copay is $275 per stay and the ER copay is $90. Lab services and diagnostic procedures have a $0 copay. X-rays have a $15 copay. Hearing exams have a $35 copay. Prescription drug benefits are not included.

Aetna Medicare Advantra Silver (HMO) – $0 monthly premium with $7,550 maximum out-of-pocket expenses. Primary care physician and specialist visit copays are $5 and $40. The in-hospital stay copay is $160 for 5 days and the ER copay is $90. Lab services and diagnostic procedures have $0-$10 copays. X-rays have a $30 copay. Hearing exams have a $45 copay. Preferred pharmacy 30-day copays are $0 (Tier 1), $0 (Tier 2), and $42 (Tier 3). Mail-order pharmacy copays are $0 (Tier 1), $0 (Tier 2), and $126 (Tier 3).

Aetna Medicare Advantra Credit Value (PPO) – $0 monthly premium with $7,550 maximum out-of-pocket expenses. Primary care physician and specialist visit copays are $10 and $50. The in-hospital stay copay is $360 for 5 days and the ER copay is $90. Lab services and diagnostic procedures have $0-$30 copays. X-rays have a $50 copay. Hearing exams have a $35 copay. Preferred pharmacy 30-day copays are $3 (Tier 1), $7 (Tier 2), and $47 (Tier 3). Mail-order pharmacy copays are $0 (Tier 1), $14 (Tier 2), and $141 (Tier 3).

Aetna Medicare Advantra Premier (PPO) – $19 monthly premium with $6,800 maximum out-of-pocket expenses. Primary care physician and specialist visit copays are $10 and $50. The in-hospital stay copay is $360 for 5 days and the ER copay is $90. Lab services and diagnostic procedures have $0-$30 copays. X-rays have a $50 copay. Hearing exams have a $35 copay. Preferred pharmacy 30-day copays are $0 (Tier 1), $0 (Tier 2), and $47 (Tier 3). Mail-order pharmacy copays are $0 (Tier 1), $14 (Tier 2), and $141 (Tier 3).

Aetna Medicare Advantra Premier Plus (PPO) – $29 monthly premium with $4,900 maximum out-of-pocket expenses. Primary care physician and specialist visit copays are $0 and $35. The in-hospital stay copay is $300 per stay and the ER copay is $90. Lab services and diagnostic procedures have $0 copays. X-rays have a $20 copay. Hearing exams have a $35 copay. Preferred pharmacy 30-day copays are $0 (Tier 1), $0 (Tier 2), and $42 (Tier 3). Mail-order pharmacy copays are $0 (Tier 1), $0 (Tier 2), and $126 (Tier 3).

Aetna Medicare Advantra Gold (HMO) – $39 monthly premium with $5,900 maximum out-of-pocket expenses. Primary care physician and specialist visit copays are $0 and $30. The in-hospital stay copay is $300 per stay and the ER copay is $90. Lab services and diagnostic procedures have $0 copays. X-rays have a $20 copay. Hearing exams have a $35 copay. Preferred pharmacy 30-day copays are $0 (Tier 1), $0 (Tier 2), and $37 (Tier 3). Mail-order pharmacy copays are $0 (Tier 1), $0 (Tier 2), and $111 (Tier 3).

Covered By Coventry?

If you were covered by a Coventry Group policy through work, and that coverage ended, you may be eligible for a conversion to a personal policy and you would not have to qualify medically. Whether you are disabled or suffer from chronic disease, you may be automatically accepted. Typically, you have 31 days from receiving the notice and approximately 90 days from leaving your employer. Aetna healthcare plans in Pennsylvania, like Coventry, are not available on an individual basis to applicants under age 65.

Pa Exchange Options

Preventative coverage is included with no out of pocket costs or waiting period. Some of the included preventative coverage includes gynecological exams, adult physicals, routine mammograms, well-child visits and routine pediatric immunizations. There are many additional preventive benefits that can be found in a policy spec sheet.

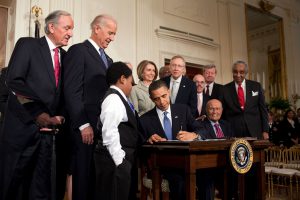

Each year the Department of Health and Human Services reviews existing free services and often adds additional options. This should continue beyond 2019, regardless of which political party holds office. Some of the most recent additions are mandatory maternity benefits and breast-feeding counseling and information. These changes are part of the Affordable Care Act legislation.

Summary

HealthAmerica was one of many large reputable companies including United Healthcare, Highmark Blue Cross Blue Shield, UPMC, Capital Blue Cross, Independence Blue Cross and Aetna. Advantra Medicare Advantage plans continue to provide popular choices for Seniors.

To compare Pa Health America options, we have provided a free quote section on the top of the page. You’ll be able to review plans along with other reputable carriers and apply for a policy. We give you more than three decades of experience and the quickest methods to purchase the benefits you need.